PRIVACY & FREEDOM OR TOTAL CONTROL?

On April 10, 2020, there was a transfer of 161,500 Bitcoins (worth $1.1 billion USD at the time) from one account to another. This transaction was completely anonymous and took approximately 10 minutes. The total fee for this transfer was about $0.68.

This transaction highlights one of the major advantages of cryptocurrency, the ability to transfer large sums quickly at low fees completely anonymously. It was later revealed that this was a transfer by an exchange to refill one of the exchange’s accounts for trading. Until the owners of the exchange came forward, there was only suspicion, but no proof, of either the sender or receiver.

In this article, I will go over the fundamental properties of money/currency, and then compare and contrast the advantages and disadvantages of cryptocurrency (Bitcoin, in particular) and a central-bank digital currency (CBDC).

Properties of Money

We all depend on money on a day-to-day basis to pay our bills and for our employers to pay us. But little thought is given to the abstract properties of money that make it so useful. Let’s go over these properties to see how they apply to both the U.S. dollar and Bitcoin.

Money needs to be fungible, that is, able to be exchanged equivalently, which we see in our current dollar system. One U.S. dollar bill may equally be exchanged for another, likewise, a current $100 bill is the same as any other $100 bill (except for exceptions of collectability). This does not hold true with all things that can be exchanged for goods and services.

In barter days, one could trade a sheaf of wheat for a few eggs. But not all sheaves of wheat are equal. Even if we impose a weight requirement, the quality of the wheat could vary from sheaf to sheaf. So, while sheaves of wheat could be used in exchange for goods and services, they were not fungible as different sheaves have different values.

Another example of a fungible object is precious metals given by weight and purity. A one-ounce silver bar at 0.999 percent purity is equivalent to almost any other such bar. This is why historically metals made a good currency. We will see they satisfy several other properties of money as well.

Money should be a store of value. U.S. bills are made from special materials to make them more durable. Precious metals, especially the so-called noble metals such as silver, gold, and platinum, make a great store of value. They maintain their weight and purity through most situations. In contrast, sheaves of wheat are not a great store of value as they can be damaged quite easily and require very specific storage to maintain their quality. But no matter how careful you are, the sheaf of wheat will eventually decay.

Money should be portable. U.S. bills are quite light and many of them can be easily transported by an individual. Even amounts in excess of $10,000 are not difficult to transport. Precious metal coins also are easily portable as their value-to-weight ratio is quite high. Though transporting a significant amount of say silver does pose a challenge. On the other hand, sheaves of wheat are not very portable.

Money should be highly divisible. U.S. currency is highly divisible as it can be divided down to the penny, which in fact has a higher value of metals than the actual currency value. Precious metals are also highly divisible as quantities down to dust can be made, weighed out and exchanged. Sheaves of wheat are divisible down to individual stalks and eventually grams of flour.

Money should be rare. The amount of U.S. currency in existence is highly controlled by the Federal Reserve. While the actual value of the physical materials of the bills is low, the “scarcity” of the bills helps maintain their value. Precious metals are also rare. The total amount of gold in the world currently is approximately 210,000 tons. Sheaves of wheat are not regulated in the amount that could be grown, except by the amount of arable land in existence.

Lastly, money should possess the single spend property. We want an individual unit of money to be spendable by an individual only once. Physical currency has this property. We need to ensure this property for digital currency.

Properties of Money Satisfied by Bitcoin

Bitcoin was designed with the fundamental properties of money in mind. It is fungible, in that one Bitcoin is the same as any other. It is a store of value in that one Bitcoin will always be one Bitcoin. Its value relative to other forms of money may change, but that happens with all currencies around the world. It is portable; all you need to access your Bitcoin is your password. It is highly divisible with the smallest division of one Bitcoin allowed by the network is 0.00000001 Bitcoin. This makes it much more divisible than standard U.S. money. Bitcoin was designed with rareness in mind and is produced through a process called mining. The total amount that will ever be mined is 21 million. This means there will always be a limit on Bitcoin, making it rare by its very nature. Transactions are grouped into blocks and transactions for accounts are tracked against account balances. This is how single spend works with Bitcoin.

What is Bitcoin?

Bitcoin is essentially a ledger keeping track of account numbers and balances that is broken into pieces called “blocks” making up a “blockchain.” The account numbers are the only thing associated with a balance; there is no other information on identity. So, the only one to know exactly who owns any particular Bitcoin is the account holder, who also possesses a secret code that allows him or her to initiate transactions.

Bitcoin is maintained by individual users supplying computing power to a joint network. To initiate a transaction, an account holder sends the following information to the network: (i) a source account, (ii) a target account, (iii) an amount of Bitcoin, and (iv) a “signed” copy of the transaction. The signature is related to the secret key kept by the user. The transaction is then sent to the network and placed into the current block.

To form the blocks of the blockchain, the Bitcoin network collects all transactions approximately every 10 minutes and then uses this information in that time period from the previous block to create the new block. Mathematical operations, called “hashes,” are performed that turn this data into a number. (The important factor about a hash is that it’s very difficult to produce two different blocks with the same hash. As a result, faking a single transaction changes the hash, invalidating the transaction.)

The network then sets about the search for a “nonce,” a number used only once. The properties of this number are that when included in the hash of the previous block and all transactions since that block was mined, the resulting hash has a set number of leading zeroes. This nonce is unique to the block, since it is the number that results in a certain number on the output. Since it is not known how to predict the output of a hash, this step is done by brute force (exhausting all possibilities, which by current computing power would take years). The number of leading zeroes is adjusted as the computing power of the network improves. The machine that finds this nonce is then awarded a number of Bitcoins, according to a predesigned schedule. This process is known as mining. The result of the mining process, finding the nonce and hashing the transactions, form a block, the next in the chain. This protocol is called a “proof-of-work” system and is the core of several cryptocurrencies, as well as Bitcoin.

It’s important to note that the process of mining is distributed across many users around the world. This makes Bitcoin decentralized in that there is no central authority certifying transactions. The security comes from the fact that the blockchain is difficult to replicate. If a malicious actor wanted to fake or erase a transaction, he or she would need to supply a fake blockchain. This would require more computational power, from more users or more computers, than is currently allocated to the Bitcoin network.

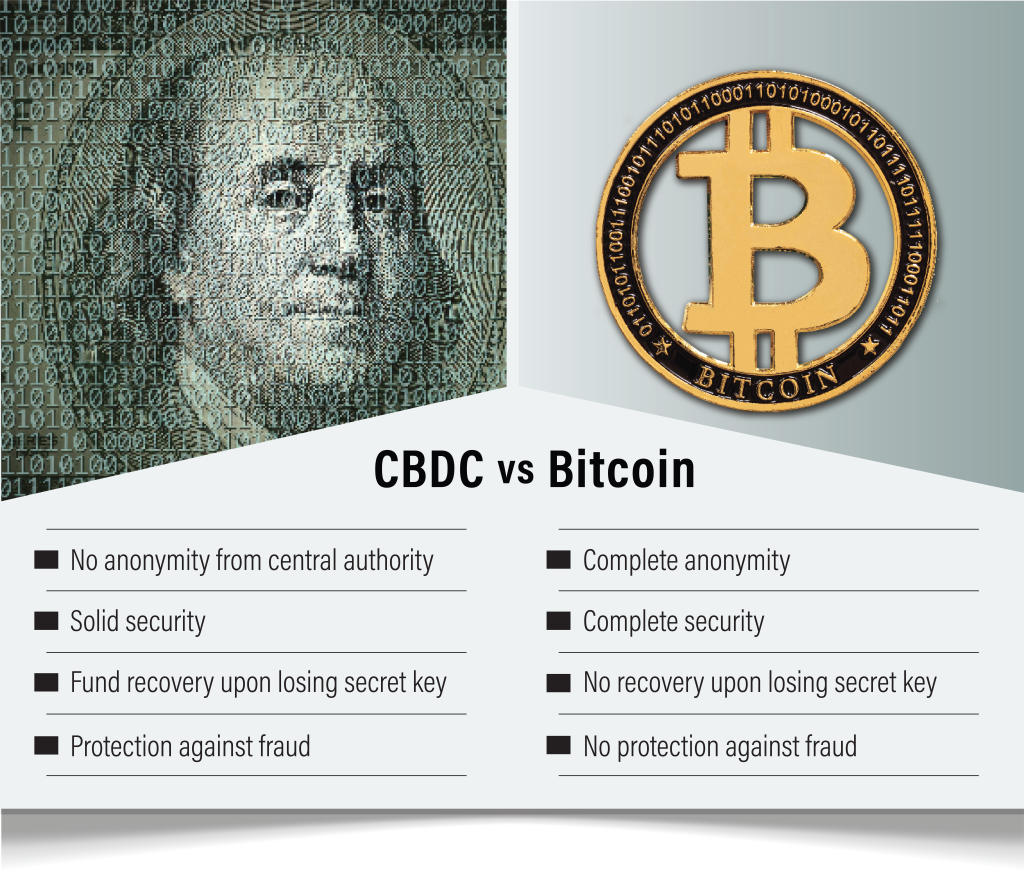

A second crucial point is that since account owners are known only to the account owner and not the network, if the secret key is lost or fraud occurs, there is no recourse for the user. There are many instances of secret keys being lost, worth millions of dollars. These Bitcoins are not recoverable, they are simply lost.

CBDC Properties

CBDC also satisfies the properties of money, outlined above. Their main differences from Bitcoin are that, first, account numbers are associated with personal identification information, that is, some institution, such as a bank, knows to whom the money belongs. Secondly, if designed properly, CBDC money is recoverable upon loss of the secret key. Lastly, there is fraud protection with a CBDC, in contrast to Bitcoin’s anonymity, which lacks this capacity.

CBDC will have single spend, fungibility, high divisibility and rarity. The rarity will come from the central issuing bank controlling the supply.

One difference with CBDC is that the blockchain will be controlled by either the central authority or by participating banks.

There is another scheme for creating blocks in a blockchain that is called “proof of stake.” This is where entities allocate any amount of the currency to the blockchain network. Then random stakeholders are chosen for validation of the blocks based on an algorithm that makes larger stakeholders more likely to be chosen. This then creates the new block and ledger system of the network.i The cryptocurrency Ethereum currently works on a proof-of-stake system, in which users allocate an amount of Ethereum to the network and then a random account is chosen, with probability based upon the amount of Ethereum pledged, to create the new block in the Ethereum blockchain.

Privacy Considerations

Some privacy advocates express concern in that all CBDC transactions are recorded. Every payment made to any person is identified on both sides by personally identifying information. While this allows for recovery of funds and fraud protection, some privacy advocates believe that it gives too much control to the central authority. They believe that this control could be used to deny funds to those with whom the central authority disagrees.

Contrast this with Bitcoin that has total privacy but absolutely no protections except security and perceived secrecy.ii

CONCERNS OVER CBDC

Many people view CBDC as the next step on a slippery slope toward control of individual lives and beliefs. Last May, Gov. Ron DeSantis signed a law banning the use of CBDC in Florida with the aim of “protecting the personal finances of Floridians from government overreach and woke corporate monitoring.”iii Gov. DeSantis, who was running for president at the time, declared, “We will nix central- bank digital currency if elected.” Robert F. Kennedy, Jr. has echoed the governor’s concerns. They have both pointed to the system emerging in China, where digital currency is linked to the social credit system.

They fear that CBDC could be utilized for continuous observation of every individual’s spending. Further, they worry about the potential of total control, for example with automatic enforcement of limits and restrictions on what everyone can buy. Lastly, there are fears that if an individual or group were to be viewed as “unfavorable” by the government or other powerful organizations, they could be debanked, that is, cut off from all banking services.

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

– Henry Ford

The current banking system already allows for much of what CBDC opponents fear: All transactions are already tracked, especially debit and credit cards. Already, a bank can cut you off from your funds, although this is currently illegal.

However, a CBDC could be developed that would greatly increase surveillance and control by enabling instantaneous monitoring of all transactions and complete real-time control over each individual’s spending habits.

Yet, according to Peter Zeihan, an acclaimed geopolitical consultant and best-selling author, to implement a totalitarian CBDC would “require several acts of Congress to be akin to the current Chinese system.”iv Accordingly, CBDC proponents argue that it would take several bad actors in government, breaking the law, to carry out what opponents fear. And if this occurred, Congress and the courts would act to uphold the American justice system. Further, Congress could pass legal and regulatory safeguards.

The author of this article believes that many of the fears voiced by CBDC opponents are valid but could be addressed through proper design. At this point, no official articulation of a CBDC has been put forward. If the Federal Reserve Board of Governors, which constitutes our nation’s central banking system, were to develop a CBDC, they could and should involve designers of several of the existing cryptocurrencies to provide a blend of securities—that is, the privacy of Bitcoin with the recoverability of credit cards, such that the currency cannot be programmed to “shut off” for particular purposes.

Yet, the only truly secure and private method of transaction is cash currency. But as with Bitcoin, there are no protections. It can be lost or stolen without much chance of recovery. Further, if you are defrauded there is not always a ready recourse.

Regardless of what happens, the author contends that digital currencies are here to stay and that if the U.S. doesn’t develop one, we will fall behind the rest of the world in banking and commerce, since CBDC allows for instantaneous digital transactions between individuals; between individuals and merchants; between business, including banks and large international corporations; and within and between governments.◙

References

i https://www.techtarget.com/whatis/feature/Proof-of-work-vs-proof-of- stake-Whats-the-difference

ii https://arstechnica.com/features/2024/01/how-a-27-year-old-busted-the- myth-of-Bitcoins-anonymity/