Curious minds may wonder if the phrase “net zero” was cooked up by media consultants to evoke the Coke Zero brand, something nice, desirable and merely a choice. The net-zero branding has certainly worked, not only captivating the green-energy punditry but, more importantly, it has deeply and dangerously infected energy policymaking and government spending.

Given the ubiquity of the term, it hardly seems necessary to define it, but “net zero” is, to put it simply, the proposed yellow-brick road to an energy future that is carbon-free. Massive spending programs and mandates are now planned in the pursuit of converting net-zero PowerPoint aspirations into the hardware needed to power society in order to replace hydrocarbons—oil, natural gas, coal—that today fuel everything, including digital infrastructures, that make civilization possible. But no imagination is needed to understand why Barclays bank, for example, recently doubled down on an oath of fealty to the net- zero vision; it is because, as they wrote, there could be “trillions of dollars to finance.”i It’s unsurprising to find that bankers ‘follow the money.’

There’s no secret as to why so many policymakers have engaged in the most expensive and ambitious intrusions into industrial policy in the history of free nations. The net-zero path is focused on an “energy transition” that would eliminate the use of hydrocarbons because combusting them necessarily creates carbon dioxide (CO2).

Transitionists imagine that legislative and fiscal manipulations will make it possible to simply choose carbon-free energy, much as one can simply choose a calorie-free Coke. Not to dwell on the branding analogy, but there’s no small irony in the fact that, just as calories are required for survival (though far less so, sugar calories), so too is CO2 required for life on earth since that molecule is to plant life what oxygen is to animal life.

Of course, it also hardly seems necessary to point out that the entirety of the great climate debate is the claim that humanity is putting too much extra CO2 into the “one atmosphere” we all share. There is no dispute that humanity is adding CO2 to the globe’s far more massive natural fluxes of CO2. And, even though there is no scientific “consensus” about the magnitude or even nature of effects from those additions—despite vigorous assertions to the contrary, the science is, in fact Unsettled, in the words of the title of physicist Steven Koonin’s bookii—one doesn’t need any knowledge or convictions about climate change in order to explore and understand the realities of energy production. They are different magisteria, to borrow a scientific construct from the late great biologist Stephen Jay Gould. Beliefs and forecasts about the future climate have nothing whatsoever to do with understanding the underlying physics, engineering and economics of machines that produce and use energy.

Indeed, we know far more, with much more certainty, about energy-producing domains than we know about atmospheric sciences. Thus, regardless of the fraught climate debate, one can explore both the prospect for and the consequences of the now monomaniacal pursuit of an “energy transition” away from hydrocarbons, including in particular: Is it even possible, at least in the time frames imagined?

> From Embargo to “Transition

History offers some lessons. In a time long ago, in 1973-74, before the internet and before the first cellphones roamed the earth, the U.S. and the world were subjected to the first modern “energy shock” with the infamous Arab Oil Embargo. That political event caused oil prices to vault by over 300 percent during the first quarter of 1974, which in turn triggered a global recession. Imagine the fallout today were such a price hike to happen.

Meanwhile, even though the embargo was a political event, policymakers back then somehow concluded that the world was in danger of running out of oil and thus enacted, both then and serially thereafter, legislation and massive spending programs to find ways to replace oil. It was the first modern quest to stimulate or accelerate an energy transition.

The result? Over the half-century since then, global consumption and production of oil increased by 12 billion barrels a year, along with an even greater overall rise in global energy use. Coal and natural gas use also increased, even more in energy-equivalent terms. The reason? Economies and populations grew and drove energy demand up faster than any alternatives to hydrocarbons could emerge and scale up to fulfill.

> Energy Demands

Understanding how energy demands occur in the first place is critical to gauging the consequences of tinkering with or constraining the availability of—or increasing the costs of—energy.

Energy demands start with the basic fact that every product or service invented, built and operated necessarily starts with mining primary materials somewhere. The global mining industry alone accounts for about 40 percent of all industrial energy use, and it runs almost entirely on hydrocarbons, especially oil.

Then those primary materials are converted, in energy-intensive processes, into the building blocks of the infrastructures of the modern era. A pound of polymers, used in everything and especially in medical domains, requires some tenfold more energy than a pound of wood, the latter still used today, but that was for eons (with stone) the dominant infrastructure material. Similarly, a pound of semiconductor silicon takes 100 times the energy to produce as a pound of steel. The world has no more moved beyond the use of steel than the use of wood, but the invention of digital communications and computers led to entirely new kinds of infrastructures. Global economies now spend nearly $1 trillion a year each on all three inputs, steel, polymers and semiconductors.

Once machines are built, there is then, self-evidently, energy used to operate them. Put in economic terms: Every $1 billion of cars purchased leads to about $100 million a year in fuel purchases; every $1 billion of aircraft drives the need for about $250 million in annual fuel purchases; and every $1 billion spent building datacenters leads to about $800 million a year in electricity consumption. Global businesses invest trillions of dollars every year building those types of machines.

The purpose of all that spending is not intended to create energy demand, but to provide services people want and like. In the ideal world, the availability and cost of energy to fuel all machines would be trivial and could be taken for granted. The economic relevance of energy costs is most easily seen in transportation domains. In a low-energy cost world, the share of a product’s final price, arising from transportation, ranges from as little as 5 percent (for lightweight things like electronics) to 25 percent (for heavy things like glass). Double the cost of energy, and the price of all products becomes inflationary.

Double the cost of energy, and the price of all products becomes inflationary.

> Energy Efficiency & Abundance

When it comes to the realities of energy demands and to the higher energy costs created by transition policies, a common response from the energy punditry is to invoke improving efficiency to simply reduce demand. Obviously, more efficiency reduces the energy costs of using a specific product. But history shows that lowering costs to produce or use a product, with rare exceptions, leads to a greater number of products sold and greater use of those products.

The energy cost of illumination has dropped some ten-thousandfold since the days of whale-oil lamps. But the quantity of illumination delivered to humanity has increased some one-hundred-thousandfold and, thus arithmetically, there’s been huge increases in the amount of energy society devotes to producing lumens. Similarly, a 300 percent decrease in airline energy use per passenger-mile over the past three decades brought with it a nearly 1,000 percent rise in total passenger- miles flown, leading to a huge increase in overall aviation energy use. And the astronomical drop in the energy cost of computing has taken that sector from a functionally non-existent energy-using domain to one now rivaling aviation.

Engineers have many more ‘tricks’ to yet deploy in pursuit of superior efficiency. But there are billions of our planet’s inhabitants who have yet to become wealthy enough to afford to buy or use very much of what the so-called “developed” nations now enjoy. If only half the world’s less fortunate eventually use one- fourth as much energy per capita as Americans, global energy demand doubles. There is, it needs to be said, a kind of iron law of global energy demand: It will rise. Thus, a central social challenge for the future remains the same as for the past, ensuring energy abundance.

[H]istory shows that lowering costs to produce or use a product … leads to a greater number of products sold and greater use of those products.

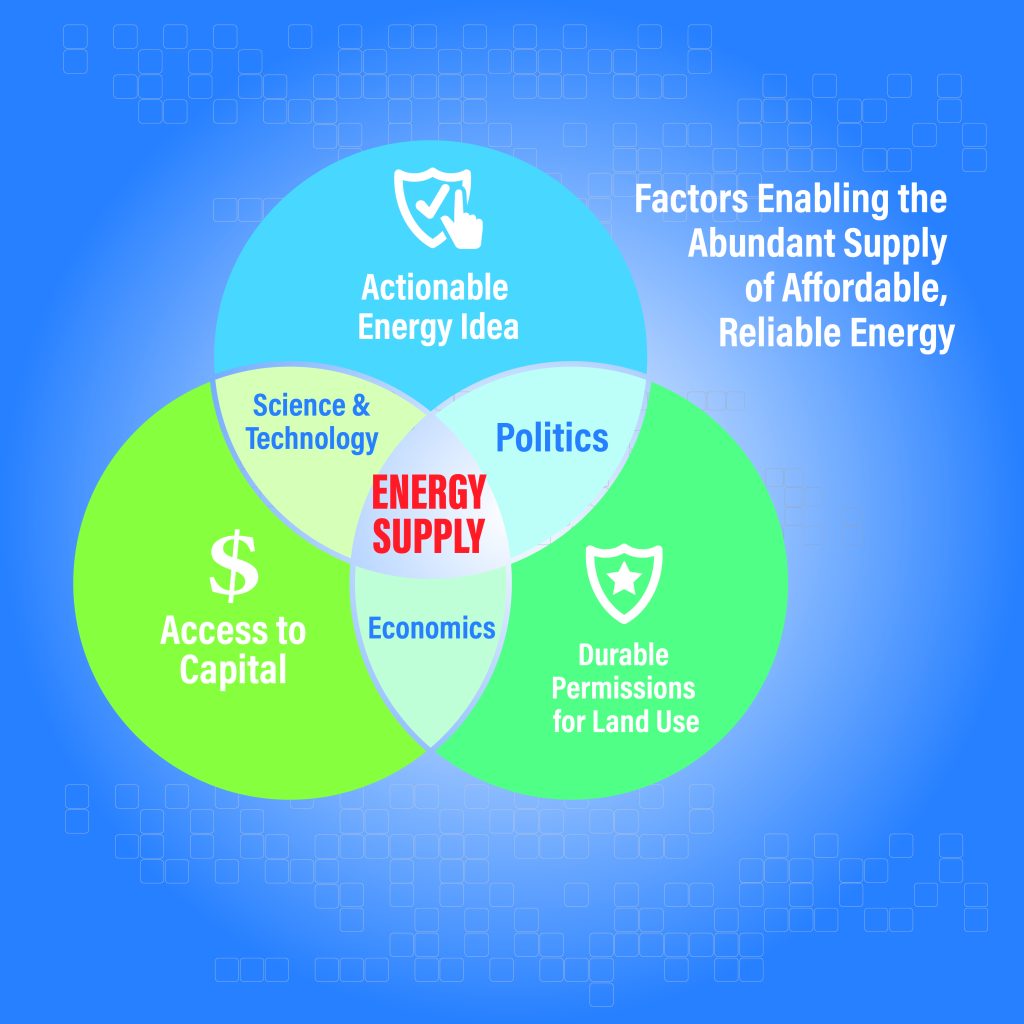

The ability to supply enough affordable, reliable energy to society is determined at the intersection of three realities: first, having an actionable idea about what it takes to build some kind of energy-producing machinery at civilization scales; second, having access to capital (energy is unlimited, capital isn’t); and, third, having durable permissions, since all of nature’s energy forms require access to land, and thus permissions, to locate the energy machinery. This means that real- world energy solutions are inherently multidisciplinary, involving science, technology, financing and politics.

> Commercial Timelines

Popular media—clickbait in the social media era—and much rhetoric in policymaking circles are preoccupied with energy ideas without appreciation for realism. Of course, there are new ideas and innovations when it comes to machines that produce or use energy. But a key feature of all the ideas proffered as “solutions” is the amount of time it takes to achieve commercial viability at civilizational scales.

The idea of a battery using lithium chemistry dates to the mid-1970s, but it didn’t reach commercial maturity for small applications for two decades, and then it took another decade to see manufacturing maturity at scale. The idea of uranium fission dates to the early 1900s, but commercial viability at scale took over a half-century to even begin. The same pattern is visible across the entire energy landscape. Today’s photovoltaic cells were first instantiated as an idea 75 years ago, and far better ideas are still needed for solar electricity to scale to global significance. For context, the hundreds of billions of dollars spent on solar and wind machines so far are supplying, combined, under 4 percent of all global energy. While there is ample evidence in the technical literature of foundationally superior photovoltaic technologies, there is no evidence that the timelines from new ideas to scale are significantly accelerating.

> Net Zero vs Energy Additions

Which brings us to the putative energy transition in search of net zero. History shows that when it comes to sources of energy, transitions don’t happen; additions do. Wood, society’s oldest energy source, still supplies threefold more global energy than does the combined output from all wind and solar hardware. Even in the U.S., wood-for-fuel is today at roughly the same level of consumption as in 1824. The “transition” that has occurred has been a huge decline in the share of supply for a far bigger economy.

Nowhere is that reality—understanding additions and shares—more starkly clear than with the preoccupation of many policymakers to mandate electric cars to cut oil use (and thus reduce CO2 emissions). Even if half of all the world’s cars (instead of today’s two percent) use batteries instead of engines, it would displace barely more than 10 percent of all petroleum use. That’s neither an existential threat to “Big Oil” nor an energy transition.

Over the last half century, the arrival of additional sources of energy, from nuclear to biofuels, to the expansion of hydroelectric dams as well as wind turbines, has left unchanged the overall per-capita global use of hydrocarbons. As for the future, even the wildly unrealistic forecasts for alternative energy from the International Energy Agency (IEA) see a world in 2050 that still gets over half of all energy from hydrocarbons. That’s lower than today’s 80 percent but that wouldn’t be close to zero.

> $200+ Trillion Quixotic Quest

The challenges faced in effecting a wholesale energy transition have been brutally highlighted in the fallout from the war in the Ukraine. It’s instructive to see just how difficult it has been for Europe to delink from Russian natural gas, a transition that entails a tiny fraction of the quantities of energy contemplated by the net-zero punditry. The most important single factor for Europe in replacing Russian gas, other than economic contraction, has been the massive increase in imports of U.S. liquified natural gas (LNG). The realities of replacing hydrocarbons can be illustrated: Matching the energy flows from a single new $2 billion LNG terminal would require building instead $60 billion of wind turbines, and natural gas would still be needed when the wind isn’t blowing.

In general, there is a fantastical naiveté to thinking it’s possible to achieve the scale of construction needed to “accelerate” to net zero. Taking the world from today, where just over 80 percent of all energy comes from hydrocarbons, to zero by 2050 would require building and installing every day for 30 years the equivalent of roughly one thousand of the 3 MW Washington- monument-sized wind turbines. It’s no wonder that the BloombergNEF (Bloomberg’s green-energy research team) transition advocates point out that something like $200 trillion of capital will be needed to build machines in pursuit of a transition.iii

A lot of that money will be spent before policymakers come to terms with the single biggest roadblock to transition aspirations. The world is not producing, nor planning to produce, the necessary quantities of underlying minerals to build the ‘green’ machines. Delivering the same energy to society compared to hydrocarbons—using wind and solar, and EVs—would require a 400 to 7,000 percent greater use of critical minerals, in particular copper, nickel and aluminum, along with minerals such as graphite, neodymium and manganese.

And that increase in demand understates the ultimate materials requirements if the goal is to entirely replace hydrocarbons that are otherwise to be relegated as back-up for dealing with the vicissitudes of wind and sun. The variable nature of the sun and wind is about more than daily and seasonal variations, but also the fact that over the decades, time periods that grids are designed to operate, it is meteorologically certain that there will be many periods of days-long solar or wind “droughts.” In theory, those can be managed by building lots of excess capacity and lots of energy storage. But that in turn means far more capital and far more critical “energy minerals” will be needed.

> Mining, Materials Famine & Inflation

Meanwhile, as the spending on transition aspirations continues, those policies will end up creating a metals famine. As noted earlier, the transition machinery entails mining and processing energy minerals at unprecedented scales. Not only is the global mining industry not expanding apace, but instead, the data show spending underway and announced for new mining capacity is in decline.

Thus, we have some irreconcilable forecasts. Copper, for example, is the single most important metal for the electrification desired in the transition. But based on existing and announced mining plans, if the demands to build EVs alone actually materialize, the world will face unprecedented shortages of copper. This says nothing about where copper and other energy minerals are refined. The epicenter for that is China, and China’s market share of refined energy minerals is roughly double OPEC’s market share of oil. Policymakers are only now starting to come to terms with the associated geopolitical and pricing risks.

Meanwhile, to imagine we can fill the gap with mines located in the U.S. runs counter to what’s happening. It’s not just that it takes a decade or two to open a new mine, but that the current federal administration is working hard to make it far harder, not easier, to open or operate a mine here. The opposition to mining is spreading around the world too, and not by accident but by design. Opposition over “equity” issues in Panama last year, to note just one example, led to the cancellation of expansion plans at one of the world’s biggest copper mines and its shutdown, temporary for now.iv

If the politically driven demand for far more minerals continues, it will stimulate a classic lesson in Econ 101 regarding demand rising faster than supply. That always leads to higher prices, something miners and their investors will appreciate, and something that eventually stimulates more supply. There is a cabal of forecasters who point to such “market forces” as inevitably solving the supply problem. There is, after all, no question that sufficient resources exist in the Earth’s crust.

The mining industry has a long history with the challenging balance between prices staying high enough, long enough for the long period of enormous capital spending needed to build new mines. That dynamic creates a natural tension between suppliers and consumers, the latter preferring lower costs, but higher costs experienced long enough lead to consumer revolt. Thus, it’s relevant to note that economists at the International Monetary Fund (IMF) analyzed the minerals supply shortfalls that the “transition” pursuits will create for the various classes of energy minerals. The IMF concluded that such pursuits will trigger history’s highest- and longest-run inflation in mineral prices. All this will happen at the same time as other government policies and central banks seek to tamp down inflation.

The CEO of Ivanhoe, one of the world’s biggest mining firms, recently attached a stark number to that dynamic, noting that the supply-demand gap could induce a tenfold hike in copper prices specifically. If copper prices spike to such levels, that would inflate all manner of goods, especially the costs of upgrading electric infrastructures, which are necessarily copper-based, and it would add $10,000 to the cost of each EV.

Faced with the irreconcilable intersection of demand and supply for minerals, many energy pundits claim technology can dig us out of that hole by making batteries, wind turbines and solar panels more efficient; that would, by definition, reduce the quantities of input materials needed. Vastly superior battery chemistry—that is, more energy stored per pound of material—by definition reduces the amount of primary materials that are required. It is reasonable to assume that innovators will indeed create and pursue superior technologies, reducing the quantity of materials needed in the first place and also bringing greater efficacy to mining. But there are a couple of caveats: timing and limits.

> Scaling Energy vs Computing Systems

An over-used and misused adjective associated with aspirational energy technologies is to expect “exponential” progress for “energy tech,” both implicitly and explicitly, invoking analogies with the pace of progress seen in computing and smartphones. But only in comic books do energy systems scale the way information systems do. The underlying physical chemistry of the best lithium batteries available, for example, entails about one-tenth the inherent energy density of petroleum. That gap can’t be closed with subsidies for yesterday’s technologies. Instead, what one sees in the real world is incremental, not exponential nor radical, progress with manufacturable technologies, including and especially large-scale batteries.

But it’s true that there are well-known bench- top chemistries that are twice as good as today’s commercial batteries—half as much material needed per unit of energy stored. However, not only does that still leave a yawning gap for minerals supplies (recall that the transition will drive a 400 to 7,000 percent increase in demand for various minerals) but new, better technologies take time to scale up, often decades. For context, today’s lithium batteries began the path to commercial viability circa 1980, but it was 30 years before the first Tesla S sedan emerged, and it’s taken another decade to scale to EVs produced at some significant level, even if still a trivial share of all vehicles.

In the theoretical world of chemical science, there is visibility for the potential for batteries to match the energy density of combustion chemistry—the two domains are scientific cousins after all. But none of the theoretical possibilities have yet seen a “lithium moment” deserving of a future Nobel Prize. As Bill Gates properly said, such classes of scientific/ technological discontinuities have “no predictor function.” Thus, the future “exponential” class of innovations, while possible, are entirely irrelevant for what can be planned for and built in the coming couple of decades. The same is true across the entire pantheon of energy technologies, ‘green’ or otherwise.

What happens in the real world is that machines we know how to build eventually approach the underlying physics and engineering limits, not least with regards to the availability and costs of input materials. That’s roughly where the state-of-the-art is with all energy-producing machines that operate at global scales, whether conventional or so-called alternatives. But now, with the rising cost of capital needed to build hardware at scale, we see that real-world costs of energy delivered by solar and wind have been rising faster than for conventional machines—the former by some 200 percent over the past five years—because using the sun and wind requires more capital and more hardware (and more land) to replace the same energy delivered by hydrocarbons. That the underlying resources— sunlight, wind—are “free” is completely irrelevant. Wood, coal, petroleum and natural gas are all free. It’s the machines (and permissions) that cost.

> No Net-Zero Machines

In addition to capital, a significant part of the cost of all machines, especially ‘green’ machines, is in the energy used to acquire, move and refine the raw materials to build the machines that subsequently harvest nature’s energy. This means that building ‘green’ machines entails a significant upstream cost in terms of CO2 emissions. In the pantheon of facts that are informative about the realities underlying the transition narratives, the energy emissions associated with building wind turbines, solar panels and EVs (never mind fueling them) mean that there are no such things as “zero emissions” machines.

While exact magnitudes of upstream CO2 emissions are difficult to document for any specific machine— the data occupying this domain are classic “known unknowns” depending on where and how the underlying materials are mined and refined—the range of facts are well-known. When it comes to EVs, the poster-child technology for the transition and the locus of hundreds of billions of dollars in subsidies, obtaining the materials and fabricating the batteries can generate a quantity of CO2 emissions that rivals the lifetime emissions of a conventional car burning oil. In other words, EV emissions merely occur somewhere else on the planet. And this says nothing about the array of other environmental and social challenges associated with mining to fabricate the EV.

There’s another ignored fact regarding those upstream emissions; they will rise in the future, not decline because of the centuries-long trend of declining ore grades. A lower concentration of metals in the rock—the ore grade—means that the next ton of minerals needed will entail far more rock dug up and processed leading to more energy use and thus more emissions to get the same future ton. This geological reality is true for essentially all metals.

> Stranded on the Yellow-Brick Road

Many of the transitionists acknowledge many of these realities about mining, manufacturing and construction, and thus propose that far more aggressive measures are needed to reduce CO2 emissions, measures directed to reducing behaviors that consume energy in the first place. For example, as the IEA proposes, those in the wealthy developed nations should reduce the amount of air travel, capping the number of flights for vacations and business; induce or mandate that houses be kept colder in the winter and warmer in the summer; convince consumers to return to clotheslines instead of dryers; and reduce overall private car use requiring instead more ride sharing, slower speeds and banning sales of conventional engines.

It is true that such behavioral changes would reduce energy use and emissions. But it is also true that there would be political and social consequences from trying to ensure that such behaviors are adopted, whether by mandates or by “inducements” through taxes that make energy more expensive. Some of the public pushback is already evident, not least in various European nations that are further down the “yellow-brick road” leading to the emerald-green transition.

> Growth, Innovation & Energy

Finally, the single biggest impediment to achieving a “transition” to a future free of hydrocarbons is the unavoidable fact that economic and population growth is always fueled by rising energy consumption. The magnitudes of what economists called “unmet demand” are devilishly difficult to predict because they arise not just from more energy demands created by more people and more wealth using more of the technologies that already exist (something reasonably forecastable), but they also come from the invention of new technologies that eventually become widely used.

Foundational innovations are always associated with an eventual significant expansion in overall energy use. It is self-evident there was no energy used for flying or driving or computing before the inventions of commercially viable machines to perform those tasks. In the cloud-era of computing, that sector’s energy use now rivals global aviation. The implicit and deeply flawed notion in long-term energy forecasts—and long-term is the core métier of transition forecasters— is that there won’t be any more foundational inventions leading to new products and services.

The International Energy Agency’s global pathway to net zero by 2030 requires annual investment to increase from $2 to $5 trillion to produce 7 percent less energy, using an area equal to India for wind, solar and bioenergy.

Energy Policy Research Foundation

History shows that humans have far more capacity to invent new things and ways to use energy than new ways to produce it. Economists have a miserable record of anticipating foundational innovations, even though there are no limits to imagination. The implications of which lead to the obvious conclusion that the energy future will be, necessarily, one of “all of the above” wherein we’ll see additions to, not transitions from, hydrocarbons.

For evidence of the implications of the iron linkages between growth and energy, we can look at the predictable outcomes from recent policy aspirations.

The U.S. is deploying billions of dollars in subsidies to reshore manufacturing without a commensurate investment in the necessary expansion of energy and especially electricity supply, nor considering that such are necessarily dependent on low-cost energy. If the U.S. were able to restore manufacturing to the same share of global production as in the year 2000, the resulting increases in domestic CO2 emissions would roughly match all the decreases hoped to come from spending on alternative energy. And this says nothing about the private sector’s rush to invest in artificial intelligence (AI) and the collateral expansion of cloud infrastructures. AI is the single most energy intensive use of silicon in history. The cloud today, before the infusion of energy-intensive AI, already uses roughly tenfold more electricity than all the world’s 30 million EVs. In energy terms, AI computing is equivalent to putting semitrailers on highways instead of Mini Coopers.

The future will see increased energy use to power those and other infrastructures. That will lead to an acceleration not deceleration in society’s overall wealth which, consequently, means an increase in energy use. The question of how we fuel cars in our near future will be roughly as consequential as thinking in terms, circa the 19th century, about how to feed horses.

One of the greatest, perhaps the greatest of human achievements has been the transition away from a time when, for most of history, 50 to 80 percent of all economic activity was devoted to acquiring fuel and food, collapsing to below 20 percent today for developed nations. That was made possible by the arrival of the age of hydrocarbons. That transition allowed the wealth of nations to be reallocated to other pursuits, those of comforts, conveniences, education, entertainments, better health and safety, and of course the modern luxury of minimizing humanity’s overall impacts on our environment.

i https://home.barclays/sustainability/addressing-climate-change/

ii https://www.barnesandnoble.com/w/unsettled-steven-e koonin/1137483249

iii https://www.bloomberg.com/opinion/articles/2023-07-05/-200-trillion-is- needed-to-stop-global-warming-that-s-a-bargain

iv https://news.mongabay.com/2023/11/panama-copper-mine-to-close-after- supreme-court-rules-concession-unconstitutional

Mark P. Mills, Executive Director, National Center for Energy Analytics

Mark Mills is the Executive Director of the National Center for Energy Analytics, a Faculty Fellow in the McCormick School of Engineering at Northwestern University and a cofounding partner at Montrose Lane, an energy fund. Mills is a contributing editor to City Journal and writes for numerous publications, including The Wall Street Journal and RealClear. Early in Mills’s career, he was an experimental physicist and development engineer in the fields of microprocessors, fiber optics and missile guidance. Mills served in the White House Science Office under President Ronald Reagan and later co-authored a tech investment newsletter. He is the author of Digital Cathedrals and Work in the Age Robots. In 2016, Mills was awarded the American Energy Society’s Energy Writer of the Year. In 2021, Encounter Books published Mills’s latest book, The Cloud Revolution: How the Convergence of New Technologies Will Unleash the Next Economic Boom and A Roaring 2020s.