Retail Davids vs. Wall Street Goliaths

“O wonder! How many ingenuous investors are there! How courageous mankind is! O brave new markets That has such retail investors in’t.”

– The Tempest (of Markets)

If, as above, we paraphrase Miranda’s words to her father, Prospero, in Shakespeare’s “The Tempest,” perhaps we would conjure the story of Vladislav Tenev and Baiju Bhatt, the founders of Robinhood Markets, Inc. In 2008, Tenev earned a bachelor’s degree in mathematics from Stanford University, and Bhatt, whom he met there, finished a master’s degree in mathematics. A year later, Tenev and Bhatt decided to start a trading company and moved to New York City.

Their first venture failed. For their second company, Chronos Research, Tenev and Bhatt created and marketed algorithmic trading software for automated transactions. “[H]edge funds and banks were using our software to place millions of transactions per day, and the portfolios they came up with were … incredibly rich,” said Tenev.[1]Spencer White, “From Physics Grad Student to Financial Disruptor: Robinhood’s Vlad Tenev, Benzinga.com, March 28, 2016, … Continue reading The duo “realized that big Wall Street firms paid effectively nothing to trade stocks, while most Americans were charged commission for every trade.”[2]https://robinhood.com/us/en/support/articles/our-story/.

Disrupting Nottingham

Tenev and Bhatt saw an opportunity to make their sophisticated software, which was powering large investment firms, available to retail consumers. In 2013, they founded Robinhood to enable the little guys to invest in stock markets and trade other financial assets directly, without the wealth management industry making decisions for them—and without having to pay transaction fees. Not only were brokerage firms charging small investors $7 to $10 per trade, but they also required a deposit of $500 to $5,000 to open an account, which Robinhood waived.

Robinhood was the first to leverage digital technology for maximum accessibility with an app, enabling ordinary people to participate in our financial system from their smart phones. Today, Robinhood has over 13 million customers, more than half of whom trade daily. This forced most brokerage firms to offer commission-free trading, which greatly increased public access to financial markets.

In so doing, Robinhood disrupted the century-old tradition of the minimum commission rule that, in 1894, the governing committee of the New York Stock Exchange (NYSE) called “the fundamental principle of the Exchange … on its strict adherence hangs the financial welfare and the life of the Institution itself.”[3]Stephen Mihm, “The Death of Brokerage Fees Was 50 Years in the Making,” Financial Advisor, January 3, 2020, … Continue reading

From Buttonwood to Vanguard

Originally, investing and brokerage firms were not meant for everyone. About 230 years ago, 24 brokers met under a buttonwood tree on Wall Street in New York City to make an agreement on the commission rates they would charge each other when trading Revolutionary War bonds and stocks from the First Bank of the United States. Today, that one-page “Buttonwood Agreement” (things were much simpler in those days) is considered the NYSE’s founding document and one of the most important financial records in American history. Trading was executed face-to-face and limited to this group of investors.

After Samuel Morse invented the telegraph in 1844, information was communicated remotely, which increased the number of potential investors. However, most Americans invested in land and commodities, such as gold, until the early 20th century. Then rising poverty and double-digit inflation provided motivation to put money into stock markets. Starting in 1913, the inflation rate (the change in the Consumer Price Index) was calculated and published monthly. Consumers not only felt the depreciation of the dollar in their pockets, but they could also read about it in newspapers and other publications.

When an economic depression hit in 1920-21, people started looking for alternative ways of accumulating wealth and often chose to invest in stock markets. Certainly, stock traders and brokerage firms made their best efforts to encourage them. Success stories of capital gains and speculation increased the number of individual traders. In 1929, more than 1.5 million customers had accounts with America’s 29 stock exchanges.[4]Murray N. Rothbard, America’s Great Depression, Ludwig Von Mises Institute, 5th edition (June 15, 2000), http://mises.org/rothbard/agd.pdf.

Nearly 600,000 families were trading on margin, which means investing their own plus borrowed money. But the more these families relied on capital gains to increase their wealth, the less able they were to pay off these loans in case of a downturn in stock prices.

As well, the growing number of investment trusts made investing more accessible and attractive.

Then the bitter experience of the 1929 Great Crash, which initiated the Great Depression, drove retail investors away from the markets until 1975, when investing in broader stock markets became available as the legendary John Bogle founded Vanguard 500, the first Index Fund. The United States Revenue Act of 1978 established 401(k) tax policies, encouraging saving and investing to benefit at least from compound interest. While these advancements made investing in overall markets and funds easier, in order to draw retail investors to individual stocks, brokerage firms needed to develop tools directly targeting them.

E(lectronic)*TRADE

The “game changer” came in 1992 from E*TRADE, which adopted a “direct-to-consumer” strategy and offered online brokerage services to ordinary Americans.[5]Jennifer Wu, Michael Siegel and Joshua Manion, “Online Trading: An Internet Revolution,” Sloan School of Management, MIT, June 1999, http://web.mit.edu/smadnick/www/wp2/2000-02-SWP%234104.pdf. Within three years, the information revolution was well underway with “multimedia PCs, which bundled sound, video and—particularly important for E*Trade—modems into relatively inexpensive and easy to install packages.”[6]https://www.company-histories.com/ETrade-Financial-Corporation-Company-History.html. The mass proliferation of digital technologies greatly increased the customer base for online trading. E*TRADE opened its website in 1995, which soon accounted for 13 percent of company sales.

By the beginning of new millennium, there were 13 million online brokerage accounts nationwide, with four million Americans trading stocks actively online—still paying transaction fees—representing 25 percent of all retail stock trades and about 15 percent of the trading volume on the NYSE and NASDAQ (a stock exchange created in 1971 by the National Association of Securities Dealers, which originally stood for the National Association of Securities Dealers Automated Quotations).[7]Wu et al., “Online Trading: An Internet Revolution.”

According to the Yankee Group IC,[8]Ibid. the top three reasons retail investors embraced digital technological disruption and traded online were low transaction fees, access to online research and convenience.

Similarly, in recent years, millennial and Gen Z retail investors prefer Robinhood for providing a mobile phone app to do all this for free. These generations also shifted their focus from funds to individual stocks such that, according to Bank of International Settlements (BIS) reports, retail investors’ holdings of individual stocks increased 100 to 200 percent. To turn a profit, Robinhood makes money by receiving rebates from brokers on order flows and by offering loans and cash management services to their clients.

Retail investors are assumed to be “noise traders”—driven by rumors such as postings on Reddit—lacking the ability to fairly price financial assets. Nobel Prize winner Milton Friedman argued that these “mistaken investors”[9]Milton Friedman, Essays in Positive Economics, University of Chicago Press, 1953. Friedman makes the case for flexible exchange rates. cannot survive in financial markets because they will buy high, sell low and eventually lose their wealth. However, we do not know how long it will take for this to happen. Noise traders tend to remain bullish (expecting prices to go higher) and extend their demands for longer time periods, which will lead them to take more risks.

Subsequent studies showed that if noise traders dominate the market over rational investors, they can increase their wealth consistently by betting against more informed traders. To accomplish this, however, they must bear greater risk tolerance and, as prices go up and their wealth grows, they tend to bet more in order to gain more, thereby compounding risk.

GameStop

Robinhood’s retail investors might be called noise traders, but they are not necessarily less knowledgeable, since they access online educational platforms, such as Coursera, and share knowledge with peers through digital forums. Dismissing retail investors as temporary noise might cost sophisticated investors dearly. The story of GameStop and similar stocks, such as AMC, teaches valuable lessons.

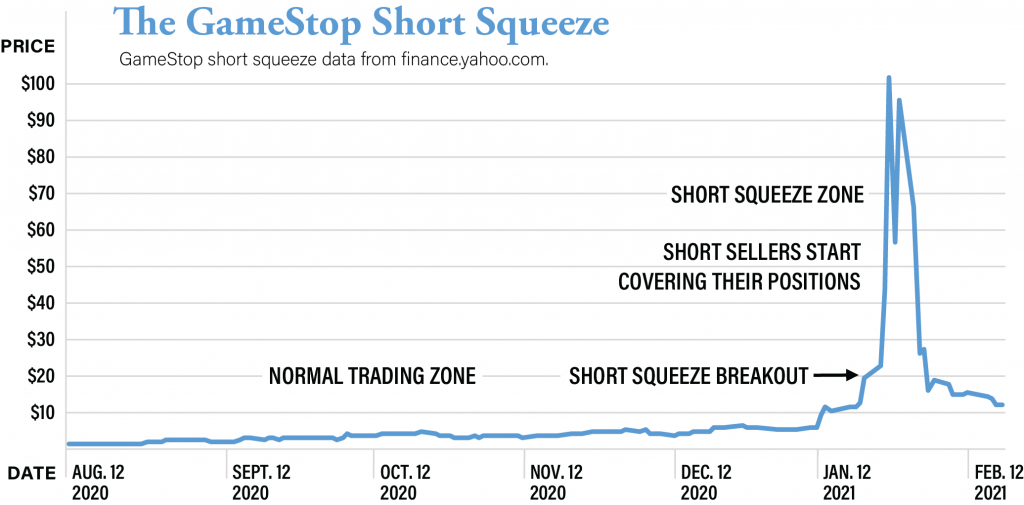

Thousands of GameStop retail investors became fired up by a narrative that if the stock price rose to a certain price point, it could only go higher. The origins of the frenzy date back to mid-2019 when some retail investors shared Reddit posts about how GameStop’s stock price could increase sharply because the stock was heavily shorted. They called it “an epic short squeeze,” a phenomenon that involves going against short sellers (bearish investors who are betting on stock prices going down).

Short sellers try to sell high first and buy low later, while posting equity to protect their brokers, who facilitate short selling by borrowing shares from other institutional investors until short sellers cover their positions. If the stock price falls, they are the winners. But if the stock price rises, short sellers will have to buy back shares to curb their losses. Then as they buy more shares, the stock price pushes even higher, which will require them to buy more shares—forcing them to slide into an endless spiral of loss. If a stock is heavily shorted, short sellers get into deep trouble when they try to buy shares to cover their losses, and no investor is willing to sell since they believe in the stock’s potential upside. Worse, short sellers also have to cover the loans they took to buy stock.

Groups of retail investors who were following heavily shorted stocks (as a percentage of total tradable shares) realized that GameStop topped the list. They knew if they pushed GameStop’s price beyond a threshold, the short squeeze would begin. Then if no one was willing to sell GameStop, the price would skyrocket—not because the market believed higher prices were the fair valuation based on fundamentals, but mostly because of pressure put on short sellers to buy.

The short squeeze happened in two phases. First, in September 2020, Ryan Cohen, a successful entrepreneur, disclosed he held an almost 10 percent stake in GameStop. Secondly, Cohen’s firm announced that it was getting more involved with GameStop in order to “produce the best results for all shareholders.”[10]Olga Kharif, “GameStop Rises on Investor’s Plan to Make it an Amazon Rival,” Bloomberg, September 22, 2020, … Continue reading At the same time, retail investors, who were waiting for a catalyst event, which would materially impact the price of a heavily shorted stock, started communicating through online posts about GameStop and drove up the stock price. Other investors, who also saw GameStop as one of the most heavily shorted stocks at the time, thought this was a once-in-a-lifetime short-squeeze opportunity and bought the stock. During the business week of January 25, 2021, GameStop was the most heavily traded stock—proving that small investors, driven by conviction, can drive the stock market.

When this began, the price for GameStop was in single digits. By January 15, the price jumped to $15, and on January 25, it surged past $100. As a result, Melvin Capital, a hedge fund that had shorted more than 100 percent of the stock—up to 140 percent, which can happen temporarily since many brokers keep borrowing stocks from various institutional investors, such as pension funds and insurance companies—was in deep trouble and had to close their position. This entailed buying back GameStop shares at a loss of $3.75 billion, which was 30 percent of the total hedge fund. Melvin Capital’s woes were tracked by retail investors who generated more than 40,000 Reddit posts.

Digital Gamma Squeeze

Robinhood and other digital platforms provide access to financial markets for retail investors, who gather and share information and then sometimes (as with GameStop) act together for the specific purpose of getting rich quick by going against institutional investors. Not only were these retail investors trading in stock markets, they were also increasing their bets in the options markets. Options require more sophisticated knowledge, but apparently that was not an issue for retail investors suffering from Covid-induced boredom. They could easily educate themselves online about complex securities.

In a nutshell, options give investors a right to purchase or sell underlying assets. Buying a call option on GameStop shares, for example, secures the price for a defined period of time. Then if buyers choose to exercise their purchase rights, sellers must buy shares—even if the price has increased—to hedge risks.

Some investors purchased GameStop call options, and as the stock price rose, options sellers had to buy more shares at higher prices, which pushed the price even higher, creating what is called the “gamma squeeze”: the combined short squeeze and options squeeze. This drove GameStop up to $430 per share.

Not surprisingly, the gamma squeeze was characterized in the media as “a populist revolt by small-time investors against big hedge funds.”[11]Shiva Nagaraj, “When Piggly Wiggly Tried to Stick It to Wall Street,” Slate, February 8, 2021, https://slate.com/business/2021/02/piggly-wiggly-short-squeeze-gamestop-wall-street-nyse.html.

Robinhood

As indicated in the graph above, tweets on January 27 by Elon Musk, Tesla’s CEO, dramatically accelerated GameStop buying. By the next day, Robinhood was forced to halt GameStop trading on its platform. Later, on February 18, Robinhood’s CEO, was summoned to testify before the U.S. House Committee on Financial Services. “[T]rading restrictions were necessary to allow us to continue to meet the clearinghouse deposit requirements that we pay to support customer trading on our platform,” Tenev explained.[12]Testimony of Vladimir Tenev, “Hearing Before the U.S. House of Representatives Committee on Financial Services,” February 18, 2021, … Continue reading Despite immense technological advancements in online trading, the settlement process in stock trading takes two days—only one day less than previously—during which customers can’t cash out.

Many investors traded on margin, which means they borrowed money to invest, thereby increasing Robinhood’s settlement risk. To cover this, Robinhood was required to place a deposit using its own funds until the trade “settled.” On January 28, Robinhood had a deposit deficit of about $3 billion. Even though the National Security Clearing Corporation, a clearing agency registered with the Securities and Exchange Commission, waived some of the excess capital obligations, the required total was too high for Robinhood to allow GameStop trading to continue.

A day later, however, Robinhood received enough capital commitments from its investors to lift the trading restrictions, after which the share price fluctuated sharply as many investors tried to capitalize on market volatility.

Then on April 19, GameStop’s CEO announced he was stepping down, which paved the way for entrepreneur Ryan Cohen to cement his control over GameStop by adding more allies to the company’s board of directors. On April 8, GameStop announced that Cohen would become company chairman.[13]Lauren Thomas, “GameStop Says It Will Name Ryan Cohen Chairman,” CNBC, April 8, 2021, https://www.cnbc.com/2021/04/08/gamestop-stock-up-after-company-says-ryan-cohen-to-be-chairman.html.

Piggly Wiggly

Did GameStop’s retail investors accomplish something unique in stock market trading? Not really. Even though some investors might not have heard about the short squeeze previously, it is not a new phenomenon. In fact, the first famous short squeeze was organized not by investors but an entrepreneur.

In 1916, Clarence Saunders founded Piggly Wiggly, the first self-serving grocery store—the model that’s ubiquitous today—in Memphis, Tennessee. Now there are more than 530 stores in 17 states, according to the company’s website. When asked why he picked such an odd name for his stores (the website reports), Saunders replied, “So people will ask that very question.”

By 1922, Piggly Wiggly was growing rapidly with 1,200 stores nationwide. The company’s stock had gone public and was listed on the NYSE. Saunders served as president and become very wealthy. After several grocery franchises (not Piggly Wiggly) went bankrupt, some Wall Street traders decided to short Piggly Wiggly stock and make a quick, lucrative profit. Saunders became enraged and decide to “break Wall Street” by orchestrating the first David vs Goliath short squeeze.

Saunders took out a loan for $10 million (almost $155 million today) and started buying Piggly Wiggly stock from the market. Within a week, he owned half of the outstanding shares and the price went up by 50 percent. Soon he owned 99 percent of the stock and Wall Street became alarmed, realizing that Saunders was cornering the market. He was in a position to squeeze short sellers, since they would have to buy from him, and he could name the price. Short sellers were facing huge losses.

Previous cornering strategies had been executed by major insiders, such as Cornelius Vanderbilt and Jay Gould. But, for Wall Streeters, Saunders was a country hick, an outsider who was trying to teach Wall Street a lesson. This could not be tolerated.

Short sellers complained to the NYSE, which set its own trading rules—the U.S. Securities and Exchange Commission had not yet been established. Not surprisingly, the NYSE (whose governing committee members were Wall Street insiders) changed its rules to suspend Piggly Wiggly trading indefinitely when the stock price peaked at $124.

This caused the stock price to drop, and Saunders couldn’t repay the $10 million loan, which was far larger than the declining worth of his shares. He resigned as president and was forced into bankruptcy.

Digitization’s Many vs the Established Few

Saunders was alone in his short squeeze, which contrasts greatly with the GameStop version. Today’s digital tools enable thousands of retail investors to join forces and create havoc in financial markets.

The efficient markets hypothesis (a dominant financial theory stating that share prices—and markets overall—reflect all the relevant information) assumes that when investors deviate from rationality, it’s a random, not interdependent, phenomenon.

Recently, we have often seen this assumption disproven. According to CNBC, one in five GEN Z and Millennial investors use online Reddit forums to drive financial decisions.[14]https://www.cnbc.com/video/2021/04/30/survey-1-in-5-gen-z-millennial-investors-use-reddit-for-investment-decisions.html. This community effect can impact markets too significantly to easily be dismissed, even if retail investors make irrational trades or suffer from confirmation bias. Real-time transfers of knowledge among retail investors strengthen them against more sophisticated institutional investors, such as hedge funds. Seasoned Wall Street investors might not be calling them “mistaken investors” anymore.

Retail investors don’t just bet their own money, they also borrow funds. This enables them to increase market leverage, which, according to a report by the Bank of International Settlements,[15]Sirio Aramonte and Fernando Avalos, “The Rising Influence of Retail Investors,” BIS Quarterly Review, March 1, 2021, https://www.bis.org/publ/qtrpdf/r_qt2103v.html. has reached greater levels than during the dot-com bubble. Options allow retail investors to further increase their leverage.

Stopping or Elevating the Game?

The retail investor-GameStop phenomenon has not gone unnoticed among conventional stock market giants. On May 1, Warren Buffett and his business partner Charlie Munger spoke at Berkshire Hathaway Inc.’s annual meeting, during which they criticized Robinhood for attracting and supporting retail investors in making casino-like bets via options. “The gambling impulse is very strong in people worldwide, and occasionally it gets an enormous shove,” Buffett said. “It creates its own reality for a while, and nobody tells you when the clock is going to strike 12, and it all turns to pumpkins and mice.” [16]John Mccrank and Jonathan Stempel, “Buffet and Munger Heap Criticism on Robinhood For Casino-Like Atmosphere,” Reuters, May 1, 2021, … Continue reading

“If the last year has taught us anything,” responded Jacqueline Ortiz, Robinhood’s Head of Public Policy Communications, in a blog post,[17]Jacqueline Ortiz Ramsay, “The Old Guard of Investing is At It Again,” https://robinhood.engineering/the-old-guard-of-investing-is-at-it-again-a8b870fbfd49. “it is that people are tired of the Warren Buffetts and Charlie Mungers of the world acting like they are the only oracles of investing. And at Robinhood, we’re not going to sit back while they disparage everyday people for taking control of their financial lives.”

Giving ordinary people free access to financial markets has a significant value. Their savings flow to companies that invest and create jobs across the country. They get a chance to increase their wealth and reach financial goals. They also have the opportunity to become tech savvy while managing their wealth.

However, these all come with significant risks. Buffet and Munger are right that impulsive, poorly informed investment decisions reap “pumpkins and mice” far more often than Cinderella’s golden carriage. These investors can drive stock markets in unpredictable ways, which makes big investors and investment firms quake. Their reactions to the GameStop saga indicate they would like to stop the small-guy investment game on platforms they don’t control, such as Robinhood. However, according to The Wall Street Journal, major Wall Street firms are now “combing through the internet forms of Reddit” and others “in search of trade opportunities.”

The horse is out of the proverbial barn. Digital access to online trading is already available to anyone with a computer or smart phone. It can’t be stopped.

Instead, to mitigate risk to both retail investors and the big guys, we need to invest in comprehensive financial literacy programs, which also develop competency in digital trading tools, at the high school and college levels. This can be done both in the classroom and via online courses, which should be available to everyone. Elevating knowledge and skills always yield significant dividends.

Fariz Huseynov, PhD, is Professor of Finance at the College of Business at North Dakota State University. He teaches undergraduate and graduate courses in corporate finance, investments and portfolio management and international finance. He holds a PhD in Finance from the University of Memphis and an MBA from Ball State University. Professor Huseynov research interests include empirical corporate finance, corporate governance and international finance. He has published his research in impactful journals, such as the Journal of Corporate Finance, Review of Corporate Finance Studies, Financial Management, and the International Review of Economics and Finance. He currently works on projects related to capital structure decisions, corporate tax avoidance and price informativeness of financial markets. He is also the Faculty Fellow for the Challey Institute for Global Innovation and Growth, where he studies post-war economic and financial development policies.

References

| ↑1 | Spencer White, “From Physics Grad Student to Financial Disruptor: Robinhood’s Vlad Tenev, Benzinga.com, March 28, 2016, https://www.benzinga.com/fintech/16/03/7762881/from-physics-grad-student-to-financial-disruptor-robinhoods-vlad-tenev. |

|---|---|

| ↑2 | https://robinhood.com/us/en/support/articles/our-story/. |

| ↑3 | Stephen Mihm, “The Death of Brokerage Fees Was 50 Years in the Making,” Financial Advisor, January 3, 2020, https://www.fa-mag.com/news/the-death-of-brokerage-fees-was-50-years-in-the-making-53447.html. |

| ↑4 | Murray N. Rothbard, America’s Great Depression, Ludwig Von Mises Institute, 5th edition (June 15, 2000), http://mises.org/rothbard/agd.pdf. |

| ↑5 | Jennifer Wu, Michael Siegel and Joshua Manion, “Online Trading: An Internet Revolution,” Sloan School of Management, MIT, June 1999, http://web.mit.edu/smadnick/www/wp2/2000-02-SWP%234104.pdf. |

| ↑6 | https://www.company-histories.com/ETrade-Financial-Corporation-Company-History.html. |

| ↑7 | Wu et al., “Online Trading: An Internet Revolution.” |

| ↑8 | Ibid. |

| ↑9 | Milton Friedman, Essays in Positive Economics, University of Chicago Press, 1953. Friedman makes the case for flexible exchange rates. |

| ↑10 | Olga Kharif, “GameStop Rises on Investor’s Plan to Make it an Amazon Rival,” Bloomberg, September 22, 2020, https://www.bloombergquint.com/technology/top-gamestop-investor-wants-to-turn-retailer-into-amazon-rival. |

| ↑11 | Shiva Nagaraj, “When Piggly Wiggly Tried to Stick It to Wall Street,” Slate, February 8, 2021, https://slate.com/business/2021/02/piggly-wiggly-short-squeeze-gamestop-wall-street-nyse.html. |

| ↑12 | Testimony of Vladimir Tenev, “Hearing Before the U.S. House of Representatives Committee on Financial Services,” February 18, 2021, https://financialservices.house.gov/uploadedfiles/hhrg-117-ba00-wstate-tenevv-20210218.pdf. |

| ↑13 | Lauren Thomas, “GameStop Says It Will Name Ryan Cohen Chairman,” CNBC, April 8, 2021, https://www.cnbc.com/2021/04/08/gamestop-stock-up-after-company-says-ryan-cohen-to-be-chairman.html. |

| ↑14 | https://www.cnbc.com/video/2021/04/30/survey-1-in-5-gen-z-millennial-investors-use-reddit-for-investment-decisions.html. |

| ↑15 | Sirio Aramonte and Fernando Avalos, “The Rising Influence of Retail Investors,” BIS Quarterly Review, March 1, 2021, https://www.bis.org/publ/qtrpdf/r_qt2103v.html. |

| ↑16 | John Mccrank and Jonathan Stempel, “Buffet and Munger Heap Criticism on Robinhood For Casino-Like Atmosphere,” Reuters, May 1, 2021, https://www.reuters.com/lifestyle/wealth/buffett-munger-heap-criticism-robinhood-casino-like-atmosphere-2021-05-01/. |

| ↑17 | Jacqueline Ortiz Ramsay, “The Old Guard of Investing is At It Again,” https://robinhood.engineering/the-old-guard-of-investing-is-at-it-again-a8b870fbfd49. |